One Stop resource for information on your company retirement benefit.

Getting Started

When can I join?

Does my employer contribute?

What if I need help deciding?

How do I enroll?

What is a 401k?

What is a Target Date Fund?

Is Roth or Pre-Tax better?

What’s my risk tolerance?

Need help?

When can I join?

You can join the plan the first day of the next month after you’ve completed 6 months of service and be 21 years old

For Example:

If you start January 15th, you will complete 6 months of service on July 15th and you can enroll on August 1st.

Does my employer contribute?

DMI Partners contributes $1.00 for every $1.00 you save, up to a 6% savings level. To receive the employer contribution, you must contribute – even if it is a small amount. Don’t Give Away Free Money

What if I need help deciding?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.

What is a 401k?

What is a Target Date Fund?

Is Roth or Pre-Tax better?

Need help?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.

Manage My 401k

How do I access my account?

What if I need advice?

What if I need to take money out?

What if I change jobs?

Should I designate beneficiaries?

Cybersecurity: How do I protect my account?

How much should I be saving?

What should I know about investing?

What if I need advice?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.

What if I need to take money out?

Saving in a retirement plan is, of course, intended to be a long-term investment for you. If you are over the age of 59.5 you can make and In-Service Distribution.

In the event of an emergency, the plan does allow for Hardship Distributions.

Schedule 1-on-1 Session Now to discuss your situation.

What if I change jobs?

Don’t Worry, you don’t lose the savings that you contributed.

Your employer may have rules about how much of their employer contributions you get to keep.

You can transfer your savings to another plan, a personal IRA or, as a last resort, you can cash out.

Before You Decide:

Schedule 1-on-1 Session Now

Should I designate beneficiaries?

In the event of your passing, your savings will transfer into the ownership of your named beneficiaries.

Make sure your named beneficiaries remain up-to-date! The most common reasons to make changes are due to marriage, divorce or having children.

Go to the Vanguard Website to view and update your beneficiaries.

Cybersecurity: How do I protect my account?

Take the following steps to help protect your account:

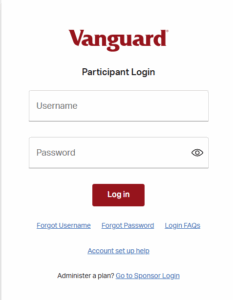

- Set up your online access and log on frequently.

- Use a strong username & password.

- Keep your contact information up to date.

- Enable Multi-Factor authentication.

- Use current anti-virus protection on all your devices.

Visit Vanguard Website for details on their Cybersecurity policy or read their Security Tips.

How much should I be saving?

What should I know about investing?

Help Beyond 401k

How can Align help me?

How much will it cost me?

Can I just talk to someone?

How can Align help me?

From helping you set your first budget to applying for Social Security, your Align coach can help you in any financial phase.

How much will it cost me?

Financial coaching is part of your retirement benefit program.

You’ll never get a bill for asking a question or requesting advice.

Can I just talk to someone?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.