One Stop resource for information on your company retirement benefit.

401k Overview

401k Video Overview (10 Min)

What happens if I do nothing?

Does my employer contribute?

Automatic Annual Increases

What if I need help making decisions?

401k Video Overview (10 Min)

What happens if I do nothing?

Automatic Enrollment: To make it easy, you automatically enroll in the 401(k) at a 3% savings level. Contributions are deducted from your paycheck before taxes, unless you make a different election.

If you do not wish to participate, you must login to opt out!

Does my employer contribute?

Clark contributes $0.50 for every $1.00 you save, up to 10%. To receive the match, you must contribute. Don’t give away free money. To maximize your benefit from Clark, aim to save 10%.

Automatic Annual Increases

For those who enroll automatically, we’ll help you improve each year by automatically increasing your savings rate after a year of service. We’ll add 1% each year until you reach 6%. You can make changes at any time throughout the year.

What if I need help making decisions?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.

Getting Started

When can I join?

How do I enroll?

What is a 401k?

What is a Target Date Fund?

Is Roth or Pre-Tax better?

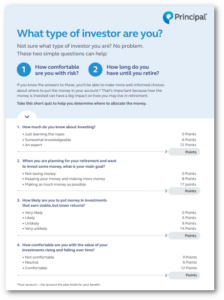

What is my risk tolerance?

Need help?

When can I join?

You can join the plan the first of the month after you’ve completed 60 consecutive days of service.

For Example:

If you start January 2nd, you will complete 60 days of service on March 3rd and will be enrolled on April 1st.

How do I enroll?

What is a 401k?

What is a Target Date Fund?

Is Roth or Pre-Tax better?

Need help?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.

Manage My 401k

How do I access my account?

What if I need advice?

What if I need to take money out?

What if I change jobs?

Should I designate beneficiaries?

Cybersecurity: How do I protect my account?

How much should I be saving?

What should I know about investing?

What if I need advice?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.

What if I need to take money out?

Saving in a retirement plan is, of course, intended to be a long-term investment for you. In the event of an emergency, the plan does allow for Hardship Distributions.

Schedule 1-on-1 Session Now to discuss your situation.

What if I change jobs?

Don’t Worry, you don’t lose the savings that you contributed.

Your employer may have rules about how much of their employer contributions you get to keep.

You can transfer your savings to another plan, a personal IRA or, as a last resort, you can cash out.

Before You Decide:

Schedule 1-on-1 Session Now

Should I designate beneficiaries?

In the event of your passing, your savings will transfer into the ownership of your named beneficiaries.

Make sure your named beneficiaries remain up-to-date! The most common reasons to make changes are due to marriage, divorce or having children.

Visit Principal to view and update your beneficiaries.

Cybersecurity: How do I protect my account?

Take the following steps to help protect your account:

- Set up your online access and log on frequently.

- Use a strong username & password.

- Keep your contact information up to date.

- Enable Multi-Factor authentication.

- Use current anti-virus protection on all your devices.

Visit Principal for details on their Cybersecurity policy.

How much should I be saving?

What should I know about investing?

Help Beyond 401k

How can Align help me?

How much will it cost me?

Can I just talk to someone?

How can Align help me?

From helping you set your first budget to applying for Social Security, your Align coach can help you in any financial phase.

How much will it cost me?

Financial coaching is part of your retirement benefit program.

You’ll never get a bill for asking a question or requesting advice.

Can I just talk to someone?

An Align coach can help you understand and navigate your financial decisions for your 401k and beyond.