Resources: Personal Financial Planning

Staying Safe in a High-Tech World Cybersecurity and Artificial Intelligence (AI)— these not just buzzwords, but two big ideas that

Dear Cautious Optimist, If the headlines have you feeling uneasy, you’re not alone. This month’s newsletter explains how Align is

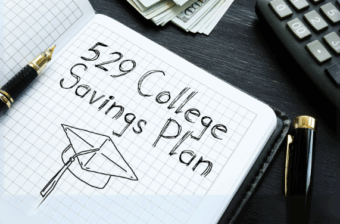

Plan Flexibility with SECURE 2.0—A Client Success Story Background Our client, a family with a long-term commitment to educational savings,

While it might not be your go-to topic for a romantic dinner date, discussing your family banking strategy can have

As the new year begins, many of us turn our attention to goal-setting. Whether it’s losing weight, training for a

As financial planning and retirement specialists, we understand the importance of a well-balanced investment strategy. While value investing has been

When it comes to money, it isn’t how much you make; it’s how you manage what you make. Whether you’re

As we kick off Cybersecurity Awareness Month this October, Align Wealth Strategies wants to empower you with practical tips to