ESG Deep Dive

ESG Investing is shorthand for Environmental, Social and Governance Investing. As stated by Investopedia, “ESG investors seek to ensure the companies they fund are responsible stewards of the environment, good corporate citizens, and are led by accountable managers.” Although ESG Investing is becoming very popular in the news, ESG investing is neither new nor political. Being completely apolitical, and in service to our client’s needs, we look at ESG investing as a toolkit that helps us align their investments with their values. Some clients may want to reduce their investment exposure to things they don’t support, such as gambling and adult entertainment. Others would like to increase their exposure to companies engaged in equitable labor and pay practices.

History of ESG Investing

Though it has gone by many names over the centuries the concept behind ESG, that is, wanting your investments to be inline with your values and convictions, is by no means novel. As many investors today want their assets to support and grow things they believe in, and, in many cases, not support things they are opposed to, it is logical to conclude that the concept is as old as investing itself.

In a recent article from Investopedia, they tell of the Jewish tradition dating back at least 3300 years that “Tzedek (which means justice and equality), comprises rules to correct the imbalances that humans cause…these rules apply to all aspects of life, including the government and the economy. Ownership carries rights and responsibilities, one of which is to prevent immediate and potential harm.”

Natural Investment wrote a blog, back in 2017 where they share that “As early as 1688, Quaker meetings in the United States were corresponding and discussing the ethical issue of profiting from the slave trade”.

According to research by State Street Corporation, ESG investing rose to prominence again during the Prohibition era, which lasted from January 17, 1920 to December 5, 1933.

At the height of Prohibition, religious-minded investors sought to avoid certain businesses that were engaged in Socially unacceptable business affairs. In 1928, one of the first “values-based” investing funds was launched, which strictly avoided tobacco, gambling, and alcohol related companies. Deemed “Socially Responsible Investing,” at that time, thus began the story of ESG investing in the United States.

In 1929 we saw the start of the Great Depression, which persisted through the end of Prohibition in 1933 and until the advent of World War II in 1939. During this time, “Socially Responsible Investing,” became more favorably termed “Responsible Investing,” as differences in socially acceptable norms emerged (likely with wave after wave of successive immigration). America became a melting pot, and it was no longer illegal or even socially unacceptable to consume alcohol, but this era was also mired by corporate greed, scandal, and many controversies. In fact, the Securities Act of 1933 emerged, which required federal registration of all public offerings of securities. Later, the Mutual Fund Act of 1940 defined operating rules for fund companies to protect investor interests. Investors were more concerned about corporate Governance than with excluding certain vices.

Responsible Investing continued to be used as a term until the 1990s when “Sustainable Investing” was introduced. In the United States, Environmental policy had emerged from the 1960s Civil Rights movement. Subsequently, on July 9, 1970, President Nixon established the Environmental Protection Agency to regulate and advocate for environment. This led to an increased awareness of environmental issues in the public eye. Investors were becoming increasingly ecologically minded, and the concept of corporate “Sustainability” emerged.

Bringing E, S, and G Together

By the 1980s, many firms began to develop core business strategy around sustainable investing. This concept brought together the Environmental, Social, and Governance issues of the past, and transformed values-based investing into a risk-management framework that we know today as “ESG investing.”

Although there is still not a single common framework for ESG investing, different frameworks have been developed independently and yet closely resemble each other. Such frameworks offer a means for analysts to assess “off-balance sheet” items that represent a combination of tangible and intangible risks and opportunities that may not be publicly reported on financial statements. As such, ESG investing requires analysts to dig deep and in different ways than a traditional investment analysis.

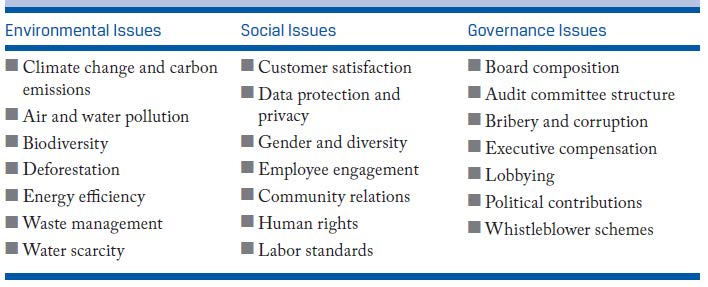

The CFA Institute provides some examples of ESG issues that ESG investors care about:

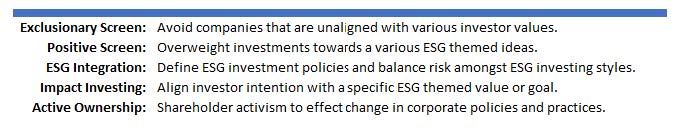

For investors, there are different “styles” of ESG investing, which range from passive screening to shareholder activism. These ESG investing styles are not mutually exclusive and in fact, many firms offering ESG investing to clients will combine different levels of engagement to hedge style concentration risk:

Why Consider ESG Issues?

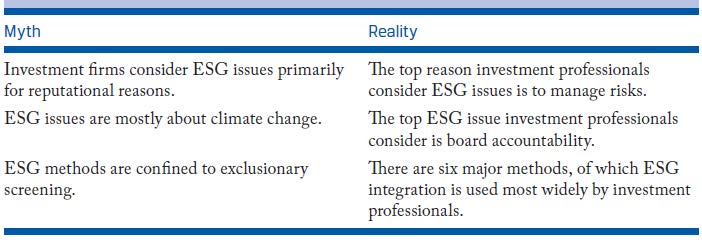

Investors are quickly becoming acquainted with the concept of ESG investing, particularly by following today’s news headlines. It has sadly become politically divisive, suggesting that it’s only a weapon to push highly sensitive, political or social agendas for groups with extreme/fringe ideologies when, in fact, ESG is apolitical. ESG investing is simply a framework that enables the alignment of investor intention with investment.

CFA Institute survey respondents were asked how they view ESG being utilized by them in their respective practices. For these respondents, managing investment risk was first and foremost, followed by satisfying client needs. This reflects the way we view ESG investing at Align.

The future of ESG style investing is growing. Presently, there is approximately $30 trillion in such funds worldwide, and is predicted this could rise to $50 trillion in the next twenty years according to ADEC Innovations. They reported on Morningstar who found that over a period of 10 years, 80% of “blend” equity funds outperformed traditionally invested peers. Moreover, 77% of ESG funds that existed 10 years ago have survived, compared with 46% of traditional funds. The reason for this is not political, or even social. We believe ESG compels analysts to consider deeper issues impacting a company, with the mindset of the investor who is interested.

If you are interested in discussing ESG investing with an advisor, please call us today!