In Laymon’s Terms – November 2025

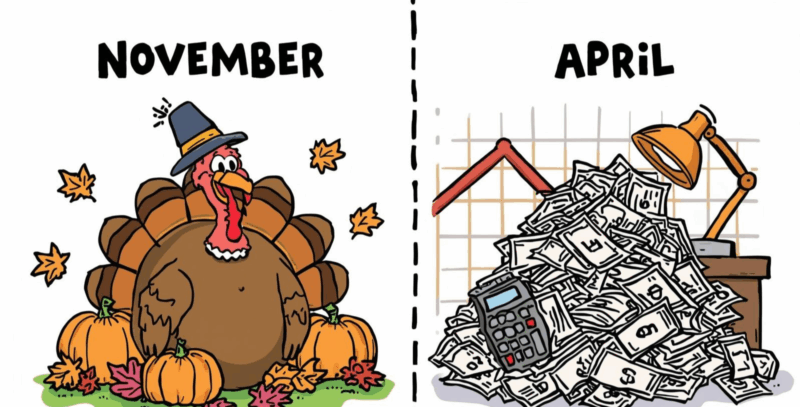

With Thanksgiving just around the corner, and a slew of Holidays between now and early Next Year, November always feels like a month leading into a time of transition. As we are wrapping up the current year, the world of finance does the same. In the financial industry, we call this “Turkey to Tax” season.

It’s based on an old adage, much like the more famous saying, “Sell in May and go away.” While we don’t manage portfolios based on catch phrases, history shows that the six months from May 1 to October 31—what some analysts jokingly call “Mommies to Mummies” (Mother’s Day to Halloween)—are often the weakest period for U.S. stocks.

On the other hand, the period we just entered, from November 1 to April 30—nicknamed “Turkey to Tax” has historically been the strongest six-month stretch for the markets.

What makes this year particularly interesting is that the preceding “Mommies to Mummies” period in 2025 was actually the best May-October stretch we’ve seen since 1950!

Historically, when the market enters November with that kind of momentum, it often continues through the end of the year. This is just behavioral finance, which means the tendency may not always hold true. But it’s interesting.

What’s more– the current bull market (a sustained period of rising prices) just turned three years old. While that may feel like a long stretch, we have experienced tremendous volatility in that time, with the most notable Trump Tariff Tremors earlier in the year. But if we take a long view, the average bull market since 1926 has lasted about 74 months—over six years running. Placing this period within a greater historical context gives us hope, as it suggests the current rally may still have room to run.

Is AI the Next Dot-Com Bubble?

This is the question on everyone’s mind. The explosion of Artificial Intelligence (AI) and the massive gains in the technology stocks driving it have drawn comparisons to the “Dot-Com” bubble of the late 1990s. When any sector skyrockets, it’s prudent to ask if the excitement has outpaced reality.

However, when we look under the hood, the current environment looks very different from the early 2000s for one crucial reason: Earnings.

During the Dot-Com bubble, investors poured money into companies that had exciting ideas but often lacked a viable business model or, crucially, any profits. Stock returns vastly outpaced actual earnings growth. Many top companies with recognizable names (no longer in existence) had bloated P/E ratios without ever turning a profit.

Today, the companies leading the AI revolution are not the same. Many of these are veritable titans of industry with past performance and robust balance sheets. While their stock prices have risen significantly, their earnings growth has largely kept pace. The recent Q3 earnings reports confirmed this, exceeding expectations yet again.

In short: the Dot-Com bubble was driven largely by speculation; the AI rally is being driven by profits.

The View from Here

As we head toward the close of 2025, we remain focused on maintaining balance. We are optimistic about the seasonal tailwinds and the innovation driving corporate earnings, but we remain vigilant regarding valuations and economic signals.

Rest assured, we are paying close attention. The investment team will continue to monitor developments and work with your advisors to make adjustments as needed. Let’s keep your financial plan on track! Please give us a call if you have any questions or concerns.

Align would like to wish you and your family a very Happy Thanksgiving!

A Wacky Thanksgiving Fact

Did you know that turkey was likely not on the menu at the first Thanksgiving?

It’s true! Based on a detailed, first-hand letter written by colonist Edward Winslow about the 1621 harvest celebration, the colonists and Wampanoag tribe celebrated with a feast that included venison (five deer were brought by the Wampanoag), “waterfowl” (like ducks and geese), and a bounty of seafood such as lobster, clams, and eel.

Source: What Food Was Served at the First Thanksgiving in 1621?