Inverted Yield Curve

What is a yield curve inversion and what does it mean today?

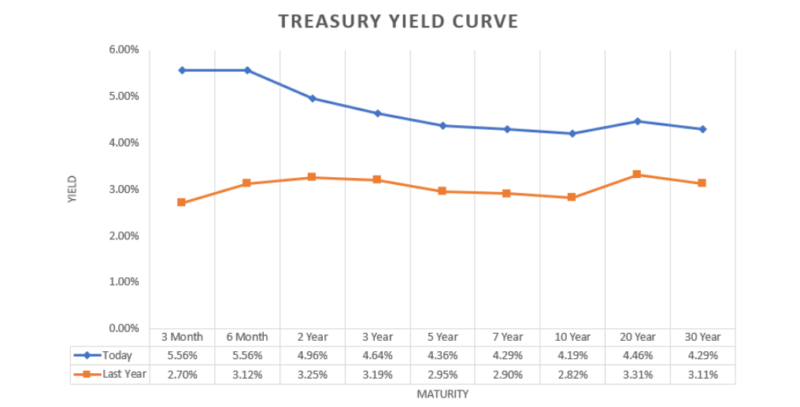

The yield curve itself is created by a chart (see above) that shows the length of time our money is committed to bonds on the horizontal X axis and the interest we receive for that length of time on the vertical Y axis. A normal yield curve is drawn from the bottom left, where time and interest is low, and extends to the upper right where time and interest is high. What makes this “normal” is that it reflects our typical expectations: that the more time we commit to an investment, the more interest we expect to receive for that commitment. It makes sense because for the time we are “locking up” our money, more lucrative investment opportunities may come and go. We would not be able to participate in those if our money was already committed. As such we will demand higher interest to compensate for this economic opportunity cost. The yield curve reflects the time-value of money, and works off of investor time-preference.

A yield-curve inversion is not a normal condition, because it reflects the opposite of what we would normally expect when it comes to the time-value of money. Short-term interest rates are higher than long-term interest rates. This means that instead of being compensated for the time we commit to an investment, we are effectively penalized. In other words, we are rewarded for investing now, instead of spending now. Interest rates can be so high over the short-term, they are almost too good to pass up. This condition creates huge problems because it slows down economic activity. Instead of spending, investors are saving—at least for the time being. Businesses suffer as people’s checking and savings accounts grow. You might think this condition would be great for banks, but it isn’t. Banks normally make money by borrowing from deposits and pay those customer low short-term rates, then lend those deposits over the longer-term and collect high interest rates. The situation has reversed with a yield-curve inversion. Banks become flush with cash deposits that they cannot lend over the long-term. This can be catastrophic to the financial system, and to the economy at-large, which relies on a normal yield curve where the time-value of money makes sense. Because they slow down the economy and prevent banks from extending credit like they normally would, yield-curves do not necessarily just predict recessions: they can cause them.

Why does a yield-curve inversion happen?

You may be wondering about the cause and potential ramifications, particularly today. Typically, a yield curve inversion happens because:

- The Federal Reserve, which is responsible for setting short-term interest rates, will raise rates very aggressively. In this environment, the Federal Reserve has raised those rates to curb inflation, which happens when the money supply has expanded beyond what the economy needs. In other words, when there are too many dollars chasing too few goods and services.

- Market forces, which react out of fear and pessimism due to risks (whether real or perceived). A short-term bond sell-off happens when people panic and buy things they may not want or need. They may also take that money and lock it up into long-term investments while long-term interest rates seem reasonable. When this happens, investors are looking to “get over the hump” of a short-term crisis. In a way, short-term interest rates reflect sentiment. Sentiment can be so powerful that it inverts the yield curve.

Right now, present conditions seem more explainable by the Fed than market forces. The Fed has issued 11 rate hikes in about a year’s time with the stated objective of controlling inflation. This is the most aggressive period of rate hiking in history, which is having the intended effect. Indeed, inflation growth rates have been tamed by this, and economic activity is present but not exuberant by any means.

What will it take for the yield curve to return to normal?

It will take two things, in our view. The Fed must feel confident that inflation has been fully nipped in the bud before it lowers rates, and once it does, the inversion will begin to take place. Secondly, we need to see greater volume of long-term bonds on the market at higher interest rates. For that to happen, institutions need to feel confident that they can commit to paying investors higher interest rates than they might be right now.

Usually, a strong economy with a long-term positive economic outlook leads to institutions feeling comfortable raising capital by issuing long-term bonds at higher rates. For the moment, neither of these are foreseeable for the remainder of the year, but anything is possible.

Written by: Erik Laymon

Date: August 18th, 2023

*Opinions expressed are for informational purposes only and are not intended as investment advice or to predict future performance or market action.